Cap Investor Update Q3 2025

We're excited to share our Q3 2025 investor update! Over the past quarter, we focused on taking our MVP to market and bootstrapping initial protocol use.

Now that Cap is live, all future quarterly investor update will be made public. In this update, you will find highlights on our progress, upcoming priorities, and asks.

Table of contents

- Highlights and Achievements

- Review of Q3 goals

- Q4 roadmap and goals

Highlights and Achievements

Reflections on launch

Cap turned 1 year old in Q3.

In just a year, what was merely an idea from one person has grown into a fully functional net-new financial primitive maintained by an A-team of crypto veterans. Speed and precision were pivotal in executing this vision into fruition.

On the product side, the code has been implemented and audited 5 times, successfully being launched to market. Our website is live today at cap.app.

On the integration side, we were welcomed across the industry: delegators, lending markets, blue chip DeFi protocols, vault curators, and liquid funds have all helped kickstart our growth.

None of this feat would have been possible without support from our investors. We’ve completed two fundraising rounds, including support from traditional institutions like Franklin Templeton, Susquehanna Crypto, Flow Traders, and IMC Trading.

We’re incredibly proud of our team and the speed at which we’ve achieved our goals. We’ve proven many of our assumptions and have adjusted for some market realities. Now that we’ve validated the initial design, it’s time to step up the pace and scale.

Below is a highlight of our achievements in Q3 2025.

1. Launched protocol

Cap launched on August 18th. Given that Cap is a complex frontier protocol, we have taken the utmost care to introduce features. No major issues have been found since launch.

In Q3, we started with USDC as the collateral asset for cUSD, and Symbiotic as the shared security network. In particular, most major delegators on Symbiotic have already started to delegate, including Renzo, Re7 Labs, MEV Capital, Stakestone, Hyperithm, and Concrete. With borrowing starting to ramp up, we expect delegations to scale as delegators build trust in the protocol.

As we enter Q4, we plan to introduce more collateral assets and shared security networks. For collaterals, we have secured deals to integrate regulated money market funds into cUSD. Additionally, EigenLayer will be added to the protocol in October, significantly increasing our total addressable market for delegations.

2. Achieved all DeFi integration targets

Prior to launch, Cap’s integration targets for cUSD were Pendle, Morpho, Curve, Euler, Dolomite, Redstone, and Chainlink. All of these integrations were accomplished within weeks of launch. They account for the majority of cUSD demand.

Most major lenders on Morpho have whitelisted Cap assets and are lending to them. These include MEV Capital, Gauntlet, Hyperithm, Clearstar, and Keyrock. This trend highlights market confidence in Cap assets.

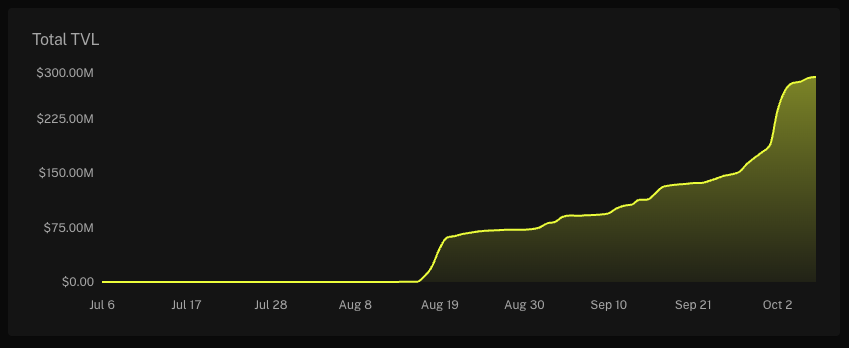

3. Bootstrapped initial TVL

From launch until the end of the quarter, Cap grew to $179M in TVL. The majority of this TVL was not from pre-arranged TVL deals, but from organic interest in the protocol. Cap’s TVL at the time of writing is $280M.

Cap’s incentive philosophy is to minimize token usage and prolong distribution of private incentives. New incentive plans will always be planned around anticipated revenue. Matching distributions with fees will allow the protocol to minimize the impact of new token unlocks.

4. Successful regional expansion into Korean market

The team made a strong push to establish a foothold in the Korean market in Q3. The results have been notable. Most of Cap’s top point holders are prominent Korean crypto users. We were able to meet many of them in our recent trip to Korea Blockchain Week. Additionally, partnerships with Korean institutions have led growth in Cap’s USD TVL, delegations, as well as operator borrowing.

Q3 goals review

Goals Met

✅ Launch Cap

✅ Have Redstone and Chainlink make cUSD oracles✅ Bluechip DeFi integration targets: Pendle, Morpho, Euler, Curve, Dolomite, and wallet providers. ✅ Launch points program for both cUSD and delegators.

Goals not met

❎ Money market funds have not yet been introduced into cUSD’s reserve. At the time of writing, Cap has already entered into legal agreements with two asset managers to whitelist Cap smart contracts for borrow/lending. Implementation to occur in Q4.

Q4 goals

Protocol KPIs

- Achieve $1Bn in total value locked.

- Increase utilization of cUSD’s reserve to over 50%.

Product

- Introduce money market funds into cUSD’s reserve.

- Launch EigenLayer AVS with redistribution slashing.

- Improve UX for new and existing delegators.

- Launch cUSD on MegaETH with Mega Mafia integrations.

Marketing

- Further standardize Cap’s marketing branding.

- Redesign website and app page.

- Hire CMO.

More Articles

Frontier Program - Epoch 3

Cap enters its third and final epoch of Frontier. Epoch 3 will begin on October 13th and last until the end of Frontier. The program may last less than the originally-intended 5 month period in the event that certain internal metrics are met. Participation boost Note that there will be a boost for users that participate in Cap consistently from earlier epochs. The longer a user participate in Frontier, the better their outcome will be. Users that leave Frontier early will not receive the full

How to Utilize stcUSD, PT-stcUSD, and PT-cUSD on Morpho

When used responsibly, leverage is a powerful tool that maximizes yields for users, and it’s all the more effective when the money legos click together so effortlessly. By combining Morpho’s efficient lending markets with Pendle’s yield-tokenization, users can construct looping positions that dramatically amplify returns on stcUSD, PT-stcUSD, and PT-cUSD positions. What is Looping Anyway? Looping is a leverage strategy in DeFi where a user repeatedly borrows against collateral and redeposits

Trade PTs and YTs Directly on the Cap App

Cap has updated our UI to allow users to directly trade Pendle PTs and YTs on the Cap App. Whether you are looking to lock in a fixed term by holding a PT or want to speculate on yield by holding a YT, this integration allows you to do so all without leaving our platform. What is Pendle? Pendle is a protocol that tokenizes yield into a trading layer for users to speculate and hedge on, letting anyone split a yield-bearing asset into two pieces, the PT & the YT, and trade them on their AMM.